News & Insights

Understanding Executive Equity Compensation

Equity compensation can be a powerful wealth-building tool for executives, but it’s essential to understand how each type works, especially

14 Investment Pitfalls to Avoid: Your Complete Retirement Guide

Retirement planning isn’t just about saving more, it’s about avoiding the costly mistakes that can quietly erode your wealth over

Should You Take the Pension Lump Sum?

For those fortunate enough to retire with a pension, one of the most important decisions is how to take the

Non-Qualified Deferred Compensation Comes Down to 2 Questions

Non-qualified deferred compensation (NQDC) plans can be a powerful tool for executives, but smart planning is essential. The key questions:

When a Roth Conversion Actually Makes Sense

A Roth conversion means moving money from a Traditional IRA to a Roth IRA and paying income tax today in

Non-Qualified Stock Options: The Biggest Mistake

One of the most common mistakes I see professionals make with non-qualified stock options (NQSOs) is treating the exercise decision

Crafting Your Optimal Social Security Strategy for a Secure Retirement

Learn to optimize your Social Security strategy. Understand claiming ages, spousal benefits, and working impacts to maximize retirement income. Essential

Trump Accounts: What Clients Are Already Asking

We’ve had several families reach out these last few weeks with questions about the new Trump Accounts for kids (also

NQDC: The 401(k) Mistake Executives Make

Non-qualified deferred compensation (NQDC) can be a powerful tool for high earners, but it’s not just a bigger 401(k). Unlike

Building Success Brick by Brick: Jennifer Ward’s Journey

Late nights. Hard decisions. Perseverance. Jennifer Ward, founder and managing partner of Ward Law, knows the meaning of grit. Jennifer’s

How to Build a Lasting Legacy: A Guide to Inheritance Planning for Families

Secure your family’s future and ensure your wishes are honored with thoughtful financial strategies. Quick Summary / Key Takeaways Inheritance

Inheriting 401(k) or IRA: Everything You Need to Know in 2026

Understanding your options for inherited retirement accounts helps you make smart financial choices. Quick Summary / Key Takeaways Most non-spouse

Pension Lump Sum or Monthly Payments? How to Make the Right Choice

Understanding your retirement payout options for a secure financial future Quick Summary / Key Takeaways Your health, life expectancy, and

Inherited Assets Don’t Come with Instructions: Navigating IRAs, Taxable Accounts, and Real Estate

Navigate inherited assets like IRAs, taxable accounts, and real estate with expert insights on tax minimization and strategic financial planning.

Trump Accounts for Kids – A Practical Breakdown

You may start hearing more about “Trump Accounts” for kids as they roll out in 2026, especially around the $1,000

Navigating a Large Inheritance: A Comprehensive Guide to Smart Financial Stewardship

Learn how to manage a large inheritance wisely. Expert advice on taxation, investing, and long-term financial planning for substantial inherited

Why Independent Financial Advisors Can Move Faster Than Big Firms

Big firms don’t turn quickly, they turn like cruise ships. Independence allows advisors to adapt faster, solve problems sooner, and

What Do Financial Advisors Do? An Overview of Common Financial Advisory Services

Discover what financial advisors do, from goal setting to debt management. Learn how a personal financial advisor provides objective, client-first

Wealth Management vs Financial Planning: Key Differences

Confused about wealth management vs financial planning? Learn the key differences, services, and how to choose the right path for

Key Benefits of Hiring a Financial Advisor

Discover the benefits of hiring a financial advisor. Gain clarity, confidence, and a personalized plan for your financial future with

Wealth Management for Entrepreneurs: A Practical Overview

Entrepreneurs: Master wealth management. Balance business growth with personal financial security. Get expert advice for cash flow, tax, and investments.

Fiduciary vs Suitability: The Difference Most Investors Don’t Understand

A suitability standard asks: “Does this investment work for you?” A fiduciary standard asks: “Is this the best option for

Why Market Booms Can Hide Bad Financial Advice

When it comes to financial advice, nobody questions their strategy when markets are soaring. It’s volatility that reveals whether advice

The Hidden Incentives Behind Financial Advice (What Investors Should Know)

How an advisor is paid matters more than most investors realize. Compensation structures influence recommendations in ways that many people

Life Insurance vs AD&D: What Your Workplace Really Covers

Reviewing your open enrollment options? Make sure you understand the two types of life insurance benefits your employer may offer:

How to Compare Spousal Benefits During Open Enrollment

As you go through open enrollment, don’t forget to compare spousal benefit options for life insurance, medical coverage, and sometimes

What’s the Value of Direct Indexing?

What if you could mirror an entire index and take charge of your tax strategy? That’s the advantage of direct

Smart Strategies to Avoid the Net Investment Income Tax (NIIT)

Are you paying the extra 3.8%—when you may not have to? The Net Investment Income Tax (NIIT) kicks in once

Why Time Matters More Than Money in Investing – Compound Interest Basics

Many young professionals think investing only works once you have a lot saved, but compounding is what actually levels the

HDHP vs HMO/PPO: How to Choose the Right Health Plan During Open Enrollment

As you make your benefit elections for the new year, understanding your health plan options can make a big difference

Disability Insurance 101: What to Review During Open Enrollment

Open enrollment is the perfect time to review your disability insurance. Here are the basics: Short-Term Disability: Covers you for

529 College Savings – What if your child doesn’t end up using it all?

What if your child doesn’t end up using all of their 529 college savings? Thanks to the SECURE 2.0 Act,

3 Types of Flexible Spending Accounts (FSAs)

Here’s a quick breakdown of the three types of Flexible Spending Accounts (FSAs): 1. Healthcare FSA: Helps pay medical, dental,

Make Childcare, Preschool, or a Babysitter Tax- Deductible? Here’s How

Paying for childcare, preschool, or a babysitter? A Dependent Care FSA can be a smart tool, making expenses you already

Navigate Your Future: A CFP Independent Financial Planner in Lancaster

Quick Summary / Key Takeaways CFP professionals offer fiduciary advice, meaning they are legally obligated to act in your best

Navigating Investment Management in Philadelphia: Your Local Guide

Quick Summary / Key Takeaways Philadelphia has many investment choices. A local advisor can offer valuable insights for your

Understanding Tax-Efficient Investing with a Pennsylvania Advisor

Quick Summary / Key Takeaways Understanding Pennsylvania’s tax landscape can play an important role in your investment plan. This

Navigating Your Finances: How Behavioral Coaching Supports Better Financial Decisions

Quick Summary / Key Takeaways Behavioral coaching helps you spot and manage common biases that affect financial choices. This

Finding Your Financial North Star: Independent Advisors in Philadelphia

Quick Summary / Key Takeaways If you only remember 5 things from this guide, make it these: Independent financial advisors

Navigate Fiduciary Financial Advisors in Philadelphia: Your Expert Guide

Quick Summary / Key Takeaways If you only remember 5 things from this guide, make it these: Fiduciary advisors

Unlocking Financial Clarity: Your Guide to Fee-Only Advisors in Lancaster, PA

Quick Summary / Key Takeaways Fee-only advisors have a legal obligation to act in your best interest. This fiduciary duty

Navigating Asset Allocation in Pennsylvania: Your Path to Clearer Financial Planning

Quick Summary / Key Takeaways Knowing your risk tolerance and financial goals is an important starting point for asset

Roth vs Traditional IRA: The Easiest Way to Pick the Right Account

Wondering which one to choose – Roth IRA or Traditional IRA? A Traditional IRA gives you a tax break now.

HSA vs FSA Breakdown: Tax Benefits, Rollover Rules & How to Choose

Confused about the difference between an HSA and an FSA? Here’s the quick version: An HSA gives you triple tax

SMART Financial Goals Explained: The Best Way to Save Money and Build Wealth

Saving more isn’t a goal but saving $3,000 in 12 months is. SMART goals give you clarity, direction, and wins

Health Insurance Made Easy: Deductibles, Copays & Coinsurance Explained

Your health insurance shouldn’t feel like a mystery. During open enrollment, it’s essential to understand three key pieces: ✔️ Your

The Secret to a Financial Plan You’ll Actually Stick To: Your Values

Want your financial plan to finally feel meaningful? Start by aligning your money with your values—travel, growth, giving, whatever matters

Beware the AI Hype: Why Some Companies Are Adding ‘AI’ to Their Name

Thinking of investing in AI? Some companies are slapping “AI” on their name, even when their business has nothing to

What Everyone Gets Wrong About the Dot-Com Bubble & And Why It Matters Now

Everyone remembers the dot-com bubble for the crash, but few remember what came after. Speculative companies disappeared but the strongest

AI Isn’t Just Software – It’s a $590B Data Center Buildout

AI isn’t just software, it’s massive infrastructure. Global data center spending is expected to hit $590B, fueling demand for

AI Bubble or Long-Term Opportunity? What Investors Need to Know in 2025

Everyone’s asking: Is AI the next dot-com bubble? 👀 Jacky and Guilian break down why the AI market could keep

Turning Market Gains Into Retirement Income: Smart Strategies for 2025

When markets reach new highs, it can be an ideal moment for more conservative investors, especially those with ample liquidity,

How High-Net-Worth Investors Use Direct Indexing for Tax-Loss Harvesting

What if you could own every stock in an index and still control your taxes? That’s the power of direct

No Tax on Tips or Overtime? Here’s What You Need to Know

The One Big Beautiful Bill introduces a unique opportunity for workers in certain industries between 2025 and 2028: No

Exchange Funds Explained: How to Diversify Concentrated Stock Without Paying Capital Gains

When a single stock has driven your success, whether from years of service, stock options, or a business you helped

Opportunity Zone Investing Explained: How to Turn Capital Gains into Tax-Free Growth

Sold a business, property, or stock with a big gain? Before you write that tax check, there may be a

Borrow Instead of Sell: How to Avoid Capital Gains Taxes and Keep Your Investments Growing

Looking to access liquidity without selling your investments? By borrowing against appreciated assets (real estate, investment portfolio, etc), you can

1031 Exchange vs DST vs UPREIT: How to Defer Taxes and Build Smarter Real Estate Wealth

Thinking about selling your investment property but worried about the tax hit? You’ve got options. ✅ 1031 Exchange: Sell and

Budgeting Isn’t About Restriction – It’s About Freedom and Direction

In this video, Paul reframes the way we think about budgeting. It’s not about cutting back or saying “no” –

A Smarter Way to Give – Gifting Highly Appreciated Stock

In this video, Chris Klein, CFP® breaks down one of the most tax-efficient ways to give: donating appreciated stock instead

Avoid the 3.8% Trap: Smart Strategies to Reduce the Net Investment Income Tax (NIIT)

Are you paying the extra 3.8% you don’t have to? The Net Investment Income Tax (NIIT) applies once your

What is a Financial Plan?

A financial plan isn’t just a spreadsheet or a list of investments – it’s a roadmap that connects your

Turn Market Volatility Into Tax Savings

When markets fluctuate, smart investors don’t just watch the numbers – they act strategically. Tax-loss harvesting lets you: –

What Is the 3.8% Net Investment Income Tax – and Who Has to Pay It?

Did you know there’s a 3.8% tax that can quietly apply to your investment income? It’s called the Net

Marquis Who’s Who Honors Jacky Petit-Homme, CFP®, CEPA®, for Excellence in Financial Services

We discuss Jacky’s journey in building a financial planning firm in Philadelphia, the value of working directly with an intimate

“Your Financial Fire Extinguisher” – Jacky Petit-Homme, CFP®

We discuss Jacky’s journey in building a financial planning firm in Philadelphia, the value of working directly with an intimate

Building Credit the Smart and Fun Way with Credit Cards

Building Credit the Smart and Fun Way with Credit Cards Credit cards are often misunderstood, but when managed wisely they

What to Consider If You’re Moving Abroad

At Liberty One Wealth Advisors, we’re fortunate to work with clients who live and spend time around the world –

How Retirees Can Maximize Charitable Giving with QCDs

Retirees often want to support their favorite causes, but taxes can complicate the process. One powerful strategy – now more

Understanding Behavioral Finance

Behavioral finance is the study of how psychology influences financial decisions. Even the most experienced investors are not immune to

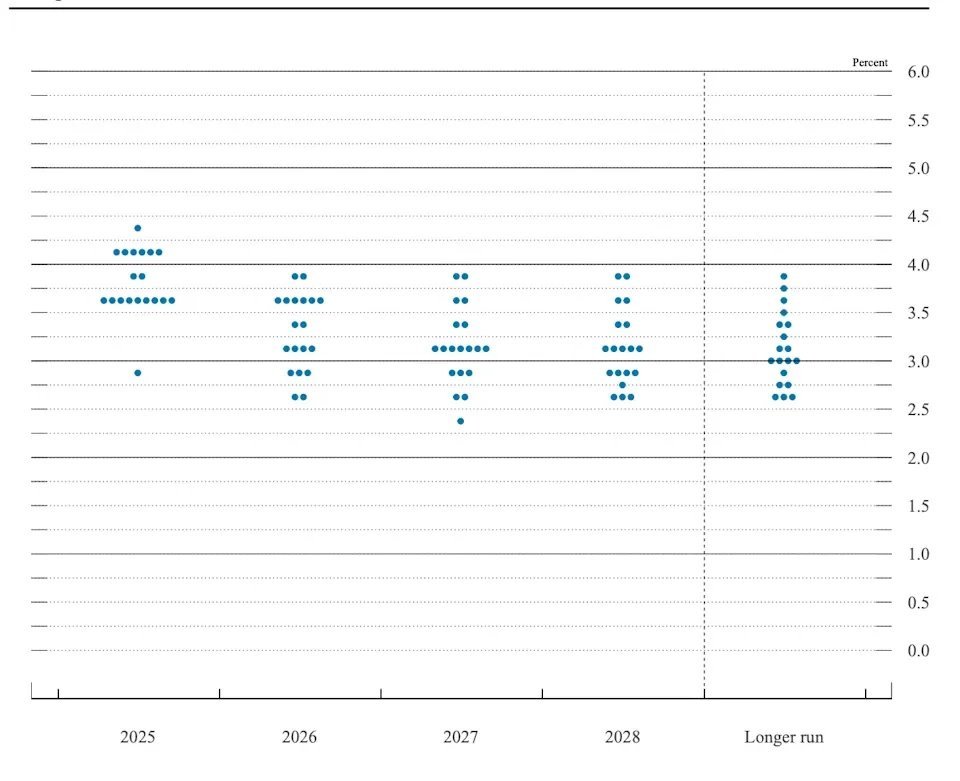

What the Fed’s Recent Rate Cut Could Mean for Investors

The Federal Reserve recently lowered interest rates by a quarter point, with more cuts possible ahead. For investors, the key

Understanding Mortgage Seasoning: What Homebuyers Need to Know

In today’s competitive housing market, many families are choosing to make all-cash offers to stand out to sellers. Paying cash

Bonus Depreciation Explained – What Business Owners Need to Know

In our latest video, we break down one of the big changes from the One Big Beautiful Bill: bonus

SALT Deduction Changes Under the One Big Beautiful Bill (OBBBA)

Starting in 2025, the state and local tax (SALT) deduction cap rises from $10,000 to $40,000 for married couples.

Do Government Shutdowns Hurt the Stock Market?

Government shutdowns make big headlines. But what do they really mean for your investments? History shows the impact is

Flexible Spending Accounts: Turning Everyday Expenses Into Tax Savings

When it comes to employee benefits, few are as practical—and as underused—as the Flexible Spending Account (FSA). FSAs let

Smart IRA & 401(k) Moves – Creating Tax-Free Retirement Money

High earners often think Roth IRAs are off-limits – but that’s not the case. Two strategies can still get

Interest Rates Are Falling – Here’s What to Consider

After several years of rising rates, we’re finally seeing the cycle turn. A lower-rate environment can create both opportunity and

Turning College Savings Into Retirement Savings – 529 to Roth IRA Transfers

What happens if your child doesn’t use all of their 529 college savings? The SECURE 2.0 Act provides a powerful

Health Savings Accounts: The Triple-Tax Advantage You Shouldn’t Overlook

When it comes to tax-efficient savings tools, few accounts rival the Health Savings Account (HSA). Originally created to help people

Tax Planning for Taxable Accounts: Understanding How Your Investments Are Taxed

When it comes to managing wealth, one of the biggest opportunities for improving returns isn’t just what you invest in—but where you hold those